What if you could predict your policyholders’ needs before they even realize them? Or, what if every customer interaction could automatically generate insights that help you sell more policies and prevent churn? Sounds like some sci-fi plot? It is not!

Scattered customer data, missed renewal opportunities, and time-consuming manual processes are silently killing the insurance business growth. Thanks to modern insurance CRM systems that consolidate customer data, analyze behavioral patterns, and utilize AI-powered analytics, insurers have found a reliable way to mitigate these challenges. These platforms turn scattered information into predictive insights. Thus, you can exactly know when a client might need additional coverage, which policies to recommend based on life changes, or how to prevent customer churn before it happens.

Table of Contents

What Is an Insurance CRM?

The insurance industry thrives on strong customer relationships. To stay relevant and competitive, insurers must meet the evolving expectations of tech-savvy policyholders. This makes efficient data collection, processing, and customer engagement more critical than ever. A well-integrated CRM for insurance agents simplifies these processes, automating workflows and enhancing productivity.

That said, insurance CRM is a specialized customer relationship management system designed to address the unique challenges of the insurance industry. The global CRM market size is projected to reach USD 163.16 billion by 2030 at a CAGR of 14.6%. This figure highlights the value a CRM solution brings to the table. Now think of the capabilities of a CRM solution specifically designed for insurance businesses!

It centralizes customer interactions, manages policies, tracks claims, and ensures seamless communication between agents, brokers, and policyholders. By providing a 360-degree view of customer data, it enables insurers to personalize services, predict customer needs, and improve decision-making. With built-in automation and analytics, CRM for insurance agents helps streamline sales, enhance compliance, and drive customer loyalty.

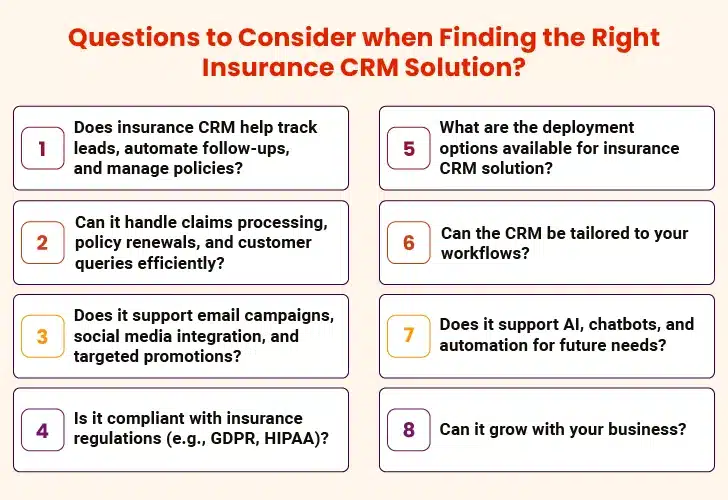

Businesses can either choose a ready-made CRM or go for tailor-made solutions designed for specific lines of insurance. However, they must consider the capabilities of the CRM while evaluating various systems. Understanding the core insurance CRM features enables insurers to understand why this software plays a pivotal role.

What Are the Core Features of an Insurance CRM?

Insurance CRM is the right tool for agents and carriers to not only manage relationships but also anticipate their needs. The features like automated lead scoring, social network analysis, 360-degree customer views, and more help insurers personalize services and drive greater business value. Let’s explore the features of an insurance CRM in detail:

1. Consolidated Database

CRM for insurance companies consolidates the databases and centralizes information related to contacts, orders, past and present transactions, policy details, claims requests, etc. This simplifies data management and eliminates silos. Consolidating diverse databases also helps insurers gain a 360-degree view of their customers, enabling them to predict customer needs and preferences. This makes room for personalized services and interactions that feel almost telepathic.

With AI-driven analytics, insurers can identify emerging trends and customer behavior patterns. These insights can be used to refine sales and service strategies.

2. Automated Report Generation

A good insurance CRM system prepares custom reports on a regular basis, with minimal human intervention and fewer chances of errors. These reports offer deep insights into policy sales, customer engagement, claims processing efficiency, and agent performance. Automated data visualization tools further enhance report readability, making complex insights easier to understand. This enables faster, strategic decision-making and helps in bridging the gap between cause and effect.

3. Email Marketing Automation

The email marketing automation feature enables insurers to nurture relationships with their existing and past customers through automated, personalized, and contextual email campaigns. Delivering relevant content at the right time helps improve customer engagement and loyalty, which ultimately drives higher policy retention and renewal rates.

What’s more, insurers can utilize AI-driven tools to segment audiences based on behavior, policy types, and engagement levels to send hyper-personalized content. Drip campaigns and real-time email performance tracking further help in optimizing marketing efforts.

4. Social Network Analysis

Modern insurance CRM systems calculate orders, reviews, likes, shares, and other activities on the company’s social media profiles. This feature enables insurers to get a better understanding of their customers by analyzing sentiment and engagement trends. AI-powered social listening tools help detect potential risks, fraud, and brand perception shifts, allowing insurers to respond proactively. Additionally, social media insights help insurers refine their digital marketing strategies and target the right audience more effectively.

5. Device Synchronization

This feature enables insurance providers to sync the system on multiple devices such as smartphones and tablets. Users can access updated customer information from any compatible device. Agents and brokers can log activities, update policy details, and respond to customer queries on the go, enhancing productivity and response times. The synchronization also ensures that any updates made on one device reflect instantly across all connected systems.

6. Calendar Notification

CRM for insurance agents can be configured to notify them about upcoming meetings, events, and essential tasks. It allows users to schedule meetings or calls and set automated reminders and notifications concerning upcoming events or tasks. The integration with Google Calendar and Outlook ensures seamless scheduling, reducing missed follow-ups and improving customer relationship management. AI-powered scheduling assistants suggest the best time slots based on past interactions and client availability.

7. Lead Assignment

The best CRM for insurance agency management classifies prospects and customers and accordingly assigns the leads to competent sales representatives or agents to drive conversions. Insurers can define rules based on which leads get assigned, thereby automating the lead generation and support processes.

Furthermore, AI-driven lead scoring helps prioritize high-value prospects, ensuring that sales teams focus on the most promising opportunities. Predictive analytics help forecast conversion rates and recommend personalized follow-up strategies.

8. Policy Management

CRM insurance software allows agents to manage policies from a centralized platform and send automated notifications on policy renewal dates. AI-powered recommendation engines analyze customer history and suggest additional policies or coverage upgrades. This improves customer experience and revenue generation while enabling cross-selling and up-selling. Agents can, thereby, ditch hefty paperwork and scattered spreadsheets, and manage all policies from a single, user-friendly platform.

9. Quick Dial

Modern CRM in insurance comes with an inbuilt feature that allows insurance agents to call the client directly from the application. This saves time and effort while ensuring that all interactions are logged automatically in the system. Integration with VoIP services and call recording features further enhance compliance and customer service quality. AI-driven call analytics provide sentiment analysis, helping agents adjust their approach based on customer emotions.

10. Commission Calculation

CRM calculates the commission received and pending from insurance companies. This function helps agents and brokers in computing taxes. Transparent commission tracking fosters a culture of accountability, motivating sales teams to improve performance. Real-time dashboard updates allow brokers to monitor their progress and set revenue goals.

11. Mechanized Workflows

CRM provides an automated platform where insurers schedule and execute tasks at predetermined times. It allows them to configure workflows to send welcome letters on the onboarding. Not only this, but agents and carriers can also share questionnaires and emails to customers for regular reminders and other purposes. AI-powered workflow optimization also suggests automation rules based on past actions. This helps streamline customer onboarding in the insurance industry and ensures consistent business operations.

12. Synchronized Outlook and Google

Insurance CRM solutions typically come with an in-build email integration system that allows them to view, organize, and send emails without leaving the platform. It keeps the data in sync in real-time and eliminates the need to toggle between different applications. This ensures all email interactions with clients are logged automatically, improving documentation and follow-up tracking. AI-powered email assistants draft responses based on previous communications.

13. Organize Meetings

Additionally, the best CRM software enables users to organize online meetings from the app itself. Stakeholders can schedule conferences and conduct meetings and issue automated reminders for the same.

14. Single Dashboard View

The single dashboard view makes it easy for users to access all functions quickly and conveniently. It offers complete visibility into sales, claims, policies, and customer interactions, reducing time spent navigating between different tools. AI-powered insights on the dashboard highlight urgent tasks, recommend actions, and provide real-time performance analytics.

15. Gen AI-Powered Customer Support

Advanced CRM solutions now integrate Generative AI (gen AI) to improve the customer support processes by providing instant responses to inquiries via chatbots and virtual assistants. These bots can handle simple routine queries, guide customers through policy selections, and even assist with claim submissions. In case of complex cases, they route them to human agents. By learning from past interactions, AI helps create a more personalized and human-like engagement.

Apart from the above-stated features, the best CRM for insurance companies must have the ability to streamline processes related to sales, marketing, and customer service. It must make it easy for insurance agents and brokers to carry out their routine tasks without any discrepancies. All in all, the customer relationship management system should benefit each party involved in the chain.

Optimize Customer Relationships and Drive Revenue

Advantages of Implementing CRM in the Insurance Industry

Given the plethora of features, insurance CRMs are changing the way insurance businesses manage client relationships. It helps them personalize services at scale and improve policy renewals and customer retention rates. Not only this, but future-looking insurers are leveraging CRM in revolutionary ways. Let’s explore some common benefits of CRM in the insurance sector:

- Enhanced PersonalizationBy consolidating a policyholder’s details, CRM solutions help insurers personalize policy offers. It helps underwriters to develop tailor-made policies based on the requirements and behavior of individual customers. Marketing teams can further use CRMs to design custom marketing and sales campaigns that generate more leads.

- 360-Degree Customer ViewCRM enables insurers to improve customers engagement with the business. The platform enables insurance agents to gain a comprehensive view of customer profiles. Agents can thereby personalize the interactions and deliver exceptional customer experiences, leading to increased brand loyalty.

- Data Management and SecurityModern-day, intuitive insurance CRM systems help prevent data loss. They allow data access to only authorized users, ultimately strengthening security. These systems also eliminate the need for scattered spreadsheets and paper-based documents. All in all, by creating a centralized location for all customer information, CRM improves data accuracy and accessibility.

- Powerful AnalyticsAI-based CRM solutions supports predictive analytics. The databases and profiles allow AI to predict the customers’ requirements, using which, sales and marketing teams draft ads and emails. They can also use these insights to reach out to customers with the right offerings at the right time. This not only boosts sales opportunities but also fosters stronger customer relationships.

- Efficiency GainsCRM systems automate a number of time-consuming, mundane tasks such as policy renewals, report generation, and data entry. This frees up the employees’ time and enables them to focus on higher-value activities, such as building stronger customer relationships, developing new products, and improving customer service.

- Improved Collaboration CRM fosters seamless collaboration and teamwork between agents, underwriters, brokers, and other stakeholders by offering a unified platform for communication and information exchange. This breaks down departmental silos and ensures everyone has access to real-time customer interactions, policy status, and claims history.

InsureCRM by Damco: Customer Relationship Management Made Simple

InsureCRM by Damco is an agile, unified platform that has all the features discussed above. It streamlines lead nurturing, workflow management, and activity tracking through intelligent automation. Here’s why you should choose Damco’s InsureCRM:

- End-to-end insurance CRM

- AI-driven insights

- Omnichannel communication capabilities

- Automated claims assignment

- Comprehensive customer profiling

- Mobile-friendly solution

- Seamless integration with core insurance modules

- Customizable workflows for brokers, agents, and carriers

Supporting claims management, underwriting, and client servicing through an intuitive single-screen dashboard, InsureCRM enables insurers to track revenue, boost conversion rates, and deliver superior customer experiences. Thus, it is the ideal choice for agencies seeking measurable ROI and operational excellence.

Conclusion

Truly speaking, the benefits of CRM in the insurance sector are multifold, if implemented appropriately. An AI-powered customer relationship management solution in insurance replaces manual labor and paperwork, increasing sales and developing a more durable connection between insurers and insureds. All in all, utilizing CRM for insurance businesses is the key to unlocking long-term success.

Case in Focus

A leading US-based health insurance provider faced many challenges due to disconnected systems. They sought a solution to unify all processes and data. In this customer success story, we helped the insurer implement a custom CRM system to provide a holistic view of customers. The implementation resulted in optimized sales operations, better customer experience, and improved claims management.